On money disorders, the power of reappraisal and how to never skip a task

41% of Millennials experience money dysmorphia

Hi there,

Recently, I shared on LinkedIn why I find working with businesses so exciting, even though coaching individuals can be incredibly fulfilling when witnessing their financial transformation.

And it's not for the reasons you might think.

The thing is, people who opt for individual coaching often come from more affluent backgrounds AND are already aware of their financial issues.

On the other hand, working with businesses allows me to connect with a much wider group of people, including those who might be skeptical or unaware of their money issues (like those dealing with money dysmorphia).

So, what’s money dysmorphia?

It's essentially the gap between how you perceive your financial situation and the actual reality.

The concept is similar to body dysmorphia, where someone looks in the mirror and sees a different reflection than what's really there: a distorted view of their appearance that others can't see!

In the same way, money dysmorphia involves an overwhelming preoccupation with a perceived flaw in your financial situation that might not be visible to others.

Money dysmorphia can impact a lot of money disorders.

Do any of these sound familiar to you?

You feel paralysed when it comes to your personal finances, because you're afraid of making the wrong choice.

You always try to save others financially or wait for someone else to rescue you.

You constantly compare yourself to others and feel like everyone is doing better.

You always want to spend money, or maybe you avoid spending altogether.

You feel guilty or ashamed after every purchase, even for essentials.

You constantly worry about not having enough money, even when your situation is stable.

41%

41% of millennials experience money dysmorphia (source)

Financial Knowledge

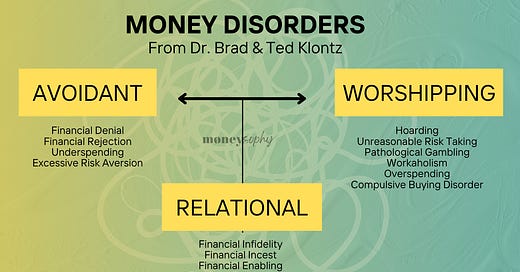

So, what causes money disorders? Childhood stories, money beliefs, emotions but also your culture, family patterns, values, life stages, and self-awareness all shape how you approach personal finances! These same factors can also lead to money dysmorphia. There are a few different types, but they generally fall into three categories: (1) Relational ones often involve complicated dynamics with others, typically a partner, parent, or child. (2) Worship ones are marked by an obsessive pursuit of status, wealth, spending or saving, and a constant desire for more. (3) Avoidant ones typically involve neglecting financial responsibilities and adopting an "out of sight, out of mind" approach.

Money Psychology

You know how therapists often

annoyinglyask you to find the silver lining in tough situations? That's part of a technique called "reappraisal." New research shows something really interesting: the amygdala, the part of your brain that handles emotions, doesn't calm down right away. It takes a bit of time after you've reappraised your emotions for the full calming effect to kick in. That's why reappraisal can feel like a lot of work at first, but it gets easier with practice. Essentially, reappraisal is about shifting your perspective to feel better. It's a powerful tool that helps you change how you think about things, and it can really make a difference. And, of course, it works with your personal finances too!

Financial Confidence

You've probably heard the saying "showing up is half the battle" but I think there's another part we tend to forget: if you're not doing what you're supposed to do it might be because your first step is just too big! So, how can you make it feel easy and tiny, so small that you can't possibly skip it? Let's use investing as an example. You could start by dedicating just five minutes each day to learning about it. Maybe spend that time reading an article, watching a quick video, or simply opening an investment account. The idea is to make it so simple that you can't help but do it.

“Plans are nothing; PLANNING is everything.”

Dwight D. Eisenhower

Self-Reflection Question

Whose life do you admire, yet might be secretly unhappy?

As always, build your financial confidence,

Sophie Hau

PS- Here's an extra tip when breaking down big tasks into smaller, manageable ones: make skipping harder! Create a system where it's more difficult to skip than to keep going. For example, you could challenge yourself to put your phone away for the next hour if you don't follow through. This way, it becomes easier to stick with your plan than to skip it. So, challenge accepted?

PSS- If you believe you might suffer from a money disorder, don’t stay alone and reach out so we can start the conversation. I’ll be replying!